Many homeowners today with changing lifestyles or growing families are choosing to improve their current homes to meet their new personal needs. This option has several important advantages over the traditional solution of “trading up” to a larger home. For one thing, it eliminates the time-consuming task and cost of moving or relocating your family. Most important, particularly in an uncertain real estate market, you don’t have to worry about selling your home. Once you are convinced that improving your current surroundings is your best ticket to your “dream home” then it is time to consider how to pay for your improvements. Explore the basic options. You may, of course, wish to use your savings, liquidate other investments, or pay for them out of your current cash flow. On the other hand, if you prefer to finance your improvements, it is helpful to be familiar with the options that are commonly available. Essentially, there are several basic approaches.

Many homeowners today with changing lifestyles or growing families are choosing to improve their current homes to meet their new personal needs. This option has several important advantages over the traditional solution of “trading up” to a larger home. For one thing, it eliminates the time-consuming task and cost of moving or relocating your family. Most important, particularly in an uncertain real estate market, you don’t have to worry about selling your home. Once you are convinced that improving your current surroundings is your best ticket to your “dream home” then it is time to consider how to pay for your improvements. Explore the basic options. You may, of course, wish to use your savings, liquidate other investments, or pay for them out of your current cash flow. On the other hand, if you prefer to finance your improvements, it is helpful to be familiar with the options that are commonly available. Essentially, there are several basic approaches.

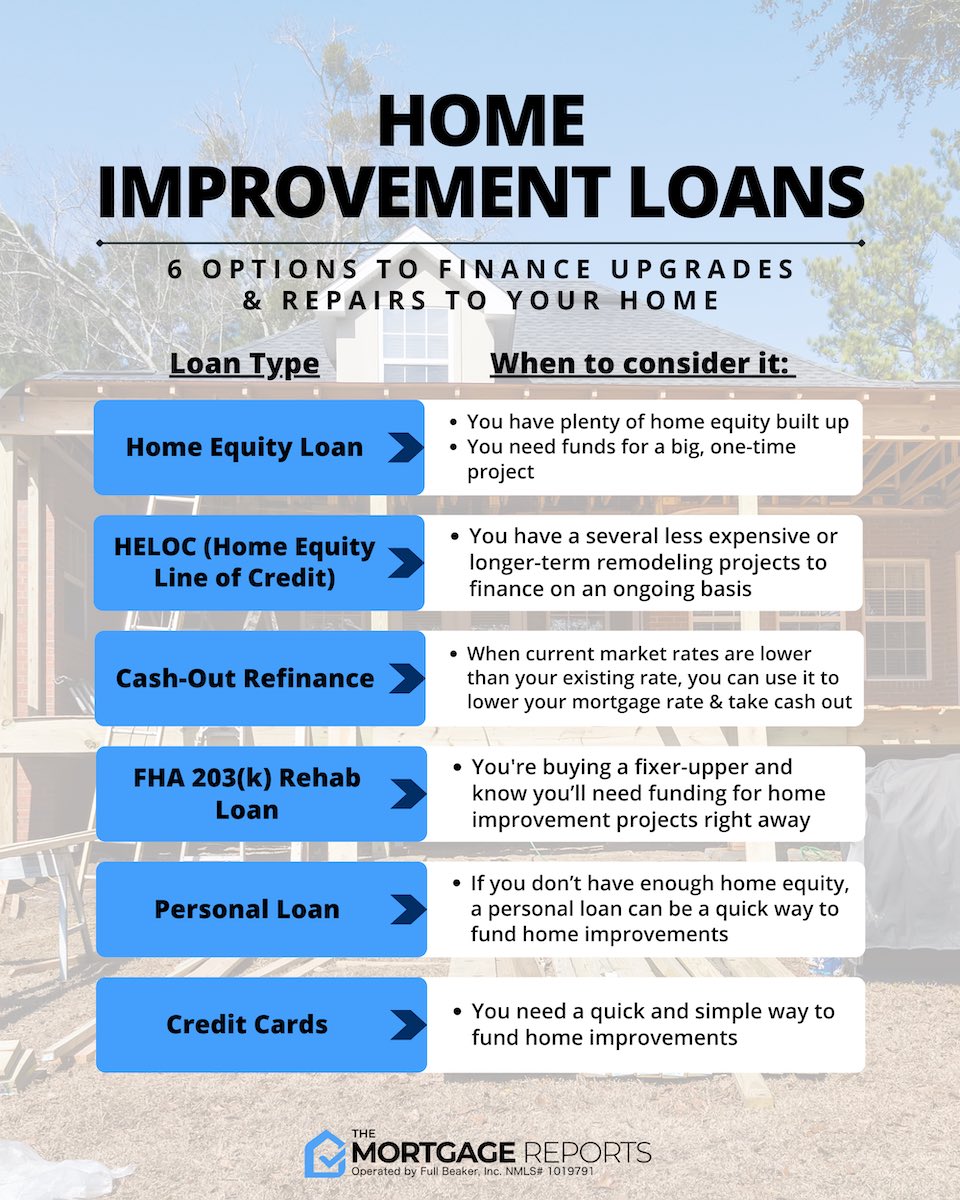

-Securing a second mortgage on your home by borrowing against the equity you have built up in it.

-Taking out an unsecured home improvement loan

-Refinancing your current first mortgage loan.

Deciding which option is best for you depends on a number of factors, ranging from the size of your borrowing needs to the repayment options of the loan programs you are considering. For example, a home equity loan offers the security of fixed interest rates. With a fixed-rate home equity loan, borrowers can avoid interest rate fluctuations. When your home equity loan closes, you receive the entire amount of the loan proceeds and begin repayment immediately. A home equity loan may be ideal if you have a major home improvement project in mind, say, adding a bedroom wing to your home, and need substantial funds right away

A home equity line of credit, on the other hand, is a flexible source of cash that is available whenever you need it Interest usually is charged only on the amount you use. This type of loan may suit your needs if you are planning more modest improvements, such as replacing your kitchen cabinets or outfitting a home gym, theater room, or a series of projects over time.

Interest rates on home equity lines of credit typically fluctuate with market conditions. When you secure a home equity loan or a home equity line of credit, the interest on the amount you borrow may be fully tax deductible on home equity amounts up to $100,000. You should consult your tax adviser for details.

Refinancing your current first mortgage loan also may be an attractive option to consider if the interest rate you are paying is higher than those available today on comparable fixed or adjustable rate mortgage loans. That is because refinancing can lower the amount of your monthly payment and give you more ready cash to use for your home improvements or any other purpose you decide is important.

There is another advantage besides giving you the opportunity to lower the interest rate on your loan. If your current loan balance is relatively modest, refinancing may be a way to borrow more so you can cover the costs of your planned home improvements. Look for product features that work for you. Beyond choosing a particular type of home equity or refinance program, you also probably want to select a loan that offers the following important benefits: schedules, for example, can translate into lower monthly payments.

Depending on your borrowing needs, you may want to select a product that permits you to borrow significant amounts, for example, up to $500,000 or more on a home equity loan, if you qualify for a competitive interest rate. Shop for a rate that is competitive, it does not necessarily have to be the lowest in town. What counts is that the financing program you choose best meets your total needs. Choose a lender who can help you select the financing program that is best for you.

Not all homeowners have the same financial needs and goals What’s more, you probably do not have the time to do all the research required to find the most suitable home equity or refinancing program for a particular home So, when you are ready to begin your home improvements, choose a lender who is an expert in real estate financing and who will work with you closely to assess your needs and select a program that meets your personal goals. Just as important, be sure your lender will expedite your loan approval. A conditional loan decision can be available in as little as 72 hours. After all, why should you have to wait a long time to start creating your “dream home?”

Sources

Berges, Steve 101 Cost-Effective Ways to Increase the Value of Your Home 2004

Good-Garton, Julie All About Mortgages: Insider Tips for Financing and Refinancing Your Home 1999